OUR TEAM

Luis Vargas

Luis Vargas is an award-winning insurance agent with over 12 years of experience in the industry. Specializing in commercial insurance, Luis is dedicated to providing tailored solutions for businesses of all sizes. Known for his expertise, professionalism, and commitment to excellence, Luis has earned the trust of countless clients by helping them safeguard their assets and achieve peace of mind.

Pilar Rondin

Pilar Rondin is a Customer Service Representative at Movar Insurance, committed to delivering exceptional support and ensuring a seamless experience for every client. With a focus on professionalism and care, Pilar is dedicated to assisting clients with their insurance needs and providing reliable solutions.

Jovanna Carranza

Jovanna Carranza serves as the Personal Lines Agent at Movar Insurance. With a passion for helping individuals and families, she is dedicated to providing personalized coverage options and outstanding service to ensure her clients feel protected and valued.

TESTIMONIALS

CUSTOMER REVIEWS

Luis has made my experience with Movar Insurance exceptionally pleasant. He is polite, patient and quickly solves any challenges that might come up. He has been a pleasure to work with.

RENA C.

Thank you, Jovanna! You went above and beyond to help me. 10 out of 10 customer service experience!

ELIZABETH C.

Get In Touch

Email: [email protected]

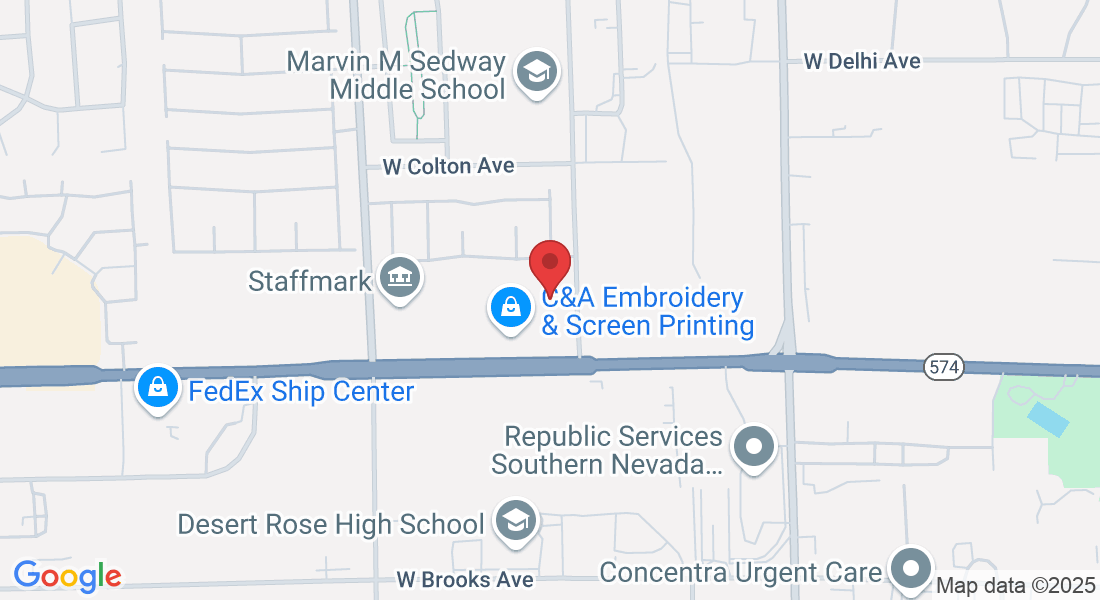

Address Office: 580 West Cheyenne Avenue Ste 30, North Las Vegas NV 89030

Assistance Hours:

Mon – Fri 9:00am - 5:00pm

Sat-Sun: Closed

FAQS

What factors affect my auto insurance premium?

Your auto insurance premium is determined by a combination of factors, including your driving history, the type of coverage you select, the make and model of your vehicle, your location, and even your credit score. Safer drivers with clean records typically pay lower premiums, while high-risk drivers may face higher rates. The specific details can vary between insurance companies, so it's essential to discuss your unique circumstances with one of our experienced agents to get an accurate quote tailored to your needs.

Can I add additional drivers to my auto insurance policy?

Yes, you can usually add additional drivers to your auto insurance policy. This can include family members, friends, or other individuals who regularly drive your vehicle. However, it's essential to provide accurate information about all drivers and their driving history when adding them to your policy.Keep in mind that adding drivers with a poor driving record or a history of accidents may increase your insurance premium. Conversely, adding experienced, safe drivers can sometimes lead to lower rates.

What happens if I let someone borrow my car, and they have an accident?

If you lend your car to someone and they have an accident, typically your auto insurance policy would be the primary coverage in most cases. Insurance typically follows the car, not the driver. So, your insurance would likely be responsible for covering the damages to your vehicle and any liability associated with the accident.However, it's essential to check your policy and consult with your insurance provider because coverage can vary. Some policies may exclude certain drivers or have restrictions on who can use your vehicle. Additionally, if the person borrowing your car has their own auto insurance, their policy might provide secondary coverage.

Email: [email protected]

Phone: (725) 246-2280

Address Office: 580 West Cheyenne Avenue Ste 30, North Las Vegas NV 89030